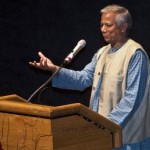

Muhammad Yunus, winner of the 2006 Nobel Peace Prize for his efforts to create economic and social development, on April 20, 2009 gave a lecture at the Joseph Meyerhoff Symphony Hall in Baltimore, Maryland. With more than 1,000 guests in attendance, Yunus’ lecture marked the kickoff of the University of Baltimore’s (UB) Merrick School Lecture Series.

Darlene Smith, dean of the Merrick School of Business, welcomed Yunus and the UB community.

“Dr. Yunus defines leadership; he defines servant leadership, and he embodies the belief that one person can make a difference,” Smith said.

“His life, his heart, his devotion, is to the poor. Thus it is no surprise that Dr. Yunus is often referred to as the banker to the poor for his pioneering work in microfinance.”

Yunus spoke on “Creating a World Without Poverty: Social Business and the Future of Capitalism,” which is the title of his most recent book; and microfinance.

Yunus said that the crisis facing the financial world today had been inevitable, only that it has become more visible today, adding that the various news media are now filled with the depressing news.

He said that when things work well, people do not see a need for change, but then people begin to think differently when things are not working well.

He said this is an opportunity to refit the entire system. “…when we are in the deepest of the financial crisis, that is the greatest of the opportunity,” Yunus said.

“Almost 2/3 of the world’s population are rejected by the financial system. They do not get any financial services,” Yunus said, adding that today, when the top 1/3 of the world’s population is having trouble getting financial services, there are many concerns raised that “it is wrong, it is not right.”

He said going forward, as the financial system gets fixed, it should be inclusive. “Nobody should be rejected from the financial system,” Yunus said.

He said that he began providing loans to the poor people in villages in his native country, Bangladesh, many years ago because of some of the problems they faced in loan shops—they were unable to secure loans for themselves because of lack of collateral security.

Yunus said he thought he could change the situation for a few people in the villages by providing them with microloans, as little as $27 to 43 people.

“If you can make so many people so happy with such a small amount of money, why shouldn’t you do more?” he said, adding that he got into a big confrontation with the conventional banks because they refused to lend the villagers money because they had no repayment guarantees.

He said he had to sign all the necessary documents on their behalf in order for money to be loaned to them.

Yunus, founder of Grameen Bank, said people should build a business on “the basis of selflessness of the human being,” so that opportunities will be created to others.

Talking about social business, he said, it makes more sense, to make money in a money-making business which is the means, and, using the money to change the world, is the end.

Someone from the audience asked Yunus a question: “You believe that someday the world would contain thousands of social businesses. What are some of the opportunities you see for creating social business in the world today?”

“Everywhere; wherever you see a problem, you create a social business to solve it,” Yunus responded. “Because that is what the social business is all about. See the conventional businesses—because they are all here to make money, they have no time to look at the problems which are created in the society.”

He said welfare could be a very good substitute of social business.

“You can design a beautiful social business plan to get welfare people out of… That’s a challenge of a social business, and you can create a business out of changing the world,” Yunus said, adding that environment could also be an excellent program of social business.

Yunus referred to his book, where he stated that approximately 47 million people living in the United States are living without health insurance, and cited a good example of social business saying, “health insurance for the people who are out of health insurance could be an excellent social business.”

He spoke on the correlation between social business and social entrepreneurship. He said social business is a business while a social entrepreneur is someone who does not actually get involved in any economic activity at all.

He said a social entrepreneur takes the initiative to help other people and the community, adding that while a social entrepreneur can be in business and make a lot of money, his message is about “being in business not for making money, but for changing the world.”

“Social business, I did it not because I want to make money,” Yunus said. “I did it—I want to help change the situation, and that’s a pure interest in me, in changing the situation, in making a difference.”

He urged young people to make a difference in the world, saying they have lots of ideas and commitments to change the world, and if they can make this commitment to work in a social business way, lots of things will happen.

“We can create our own world. We have to believe in it. If you believe in it, then you can create it,” Yunus said.

Also see:

· Maryland State Officials And Business Leaders Gather To Discuss New Business Strategies

· CBCF’s “Economic Recovery Forum” Lays The Basics On “Preparing To Start Your Business”

· Ross: We Need To View Security As An Investment In Our Mission’s Success

. “We Have Got To Reach Higher Heights,” Congressman Cummings Said At The CBCF “Economic Recovery Forum”

> Click Here to return to IB’s Blog Home Page

> Click Here to return to Ibdabo.com Home Page